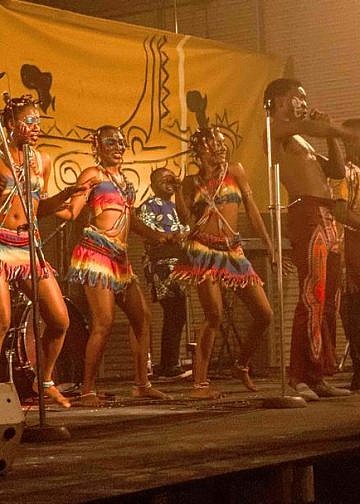

The Microfinance Support Centre (MSC), in collaboration with the Uganda Revenue Authority (URA), Uganda Registration Services Bureau (URSB), and the Uganda National Bureau of Standards (UNBS), convened an engagement in Jinja to raise awareness on product certification, tax education, and business registration among Emyooga SACCO beneficiaries.

The session brought together 52 representatives from various Emyooga SACCOs across Eastern Uganda.

Francis Elwoku, the MSC Regional Manager for Eastern Uganda, led the discussions, emphasizing MSC’s commitment to supporting Emyooga SACCOs in scaling up their operations to access larger markets.

He noted that MSC is working closely with government agencies to help SACCOs register their businesses, obtain necessary certifications, and embrace tax compliance.

“We are dedicated to capacity building and ensuring that these SACCOs meet the required standards to thrive. Our goal is to support them in producing high-quality products that can compete not only locally but also internationally,” Elwoku stated.

He further highlighted that MSC is actively working with its partners to ensure that the SACCOs gain the necessary knowledge and tools to transition into profitable and tax-compliant businesses.

During the engagement, representatives from URSB, URA, and UNBS provided key insights to the SACCO members.

Lydia Nanono from URSB guided participants through the business registration process, stressing the benefits of formalizing enterprises.

“Registering your business provides a foundation for growth and legitimacy. Choose a unique and catchy name, and ensure you have a national ID and a clear business location description,” she advised.

Hafsah Seguya, a Tax Education Officer at URA, addressed common concerns about taxation, urging SACCO members to view tax compliance as a national duty rather than a burden.

“For our country to develop, taxes must be paid. However, we acknowledge the concerns of small-scale businesses. It is crucial to register, obtain a Tax Identification Number (TIN), and understand your tax obligations,” Seguya explained.

She also warned against sharing TINs to avoid fraudulent activities.

UNBS officials stressed the need for product certification, advising SACCO members to adhere to quality standards to access wider markets. They assured them of guidance in meeting the necessary certification requirements.

Amid discussions on taxation, SACCO members, led by Sylvia Nafuna of Northern City Division Constituency Produce Dealers Emyooga SACCO, appealed to the government for a three-year tax waiver.

Nafuna highlighted that most SACCOs are in their infancy and need a grace period to establish themselves before they can meet tax obligations.

In response, Michael Kasedde, the Assistant RCC of Jinja City, reassured participants that the government is considering the proposed tax holiday, which is likely to be passed by July 1st.

“Your concerns have been heard, and steps are being taken to address them. However, it is essential that you remain committed to your work plans and focus on producing high-quality products,” Kasedde stated.

The engagement provided SACCO members with valuable insights into business growth, tax compliance, and product certification.

With continued collaboration between MSC, URA, URSB, and UNBS, Emyooga beneficiaries are expected to gain the necessary support to grow their businesses into sustainable and competitive enterprises.

Participants praised MSC for providing them with the opportunity to engage directly with authorities, stating that the session helped them understand the areas they need to improve. They pledged to streamline their startups using the knowledge gained.

“This engagement has truly opened my eyes to many things. Now, I understand how to smoothly register our SACCO. When I return, I will guide other members in addressing the gaps we have,” said Ms. Lilian Sansa from Jinja Northern Division Women Entrepreneurs Emyooga SACCO.