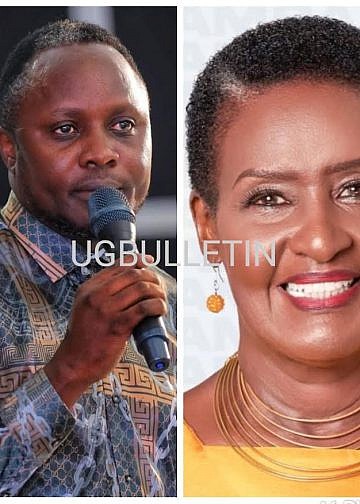

Absa Bank Uganda has honoured outgoing board chairperson Nadine Byarugaba and board member Prof. Barnabas Nawangwe for their exceptional contributions to the bank. The farewell dinner, held at Kampala Serena Hotel, celebrated their transformative leadership and dedication during their tenure.

During the event, acting board chairman George Opio praised Byarugaba’s leadership, which he said was pivotal in driving Absa Bank’s growth despite challenges like the COVID-19 pandemic.

Under her stewardship, the bank solidified its position among Uganda’s top three commercial banks, achieving remarkable milestones.

“It was through her strategic vision, business acumen, and commitment to excellence that Absa grew from being among Uganda’s top ten banks to emerging as one of the top three. Her leadership prompted innovation and positioned Absa as a preferred banking partner,” Opio said.

Under Byarugaba’s leadership, Absa Bank achieved an impressive 256% growth in profitability, closing 2023 with a profit of Shs146 billion, up from Shs41 billion in 2020.

Revenue increased by 50.1%, reaching Shs475 billion from Shs316 billion in 2020, while customer deposits rose to Shs2.856 trillion, reflecting a four-year cumulative growth rate of 4.9%.

These accomplishments were attributed to customer engagement, digital investments, and strategic initiatives to enhance transactional banking and trading income.

The bank also reported growth in customer assets, which now stand at Shs1.769 trillion, maintaining a cumulative growth average of 7.9%.

Absa’s Managing Director, Mumba Kalifungwa, lauded Byarugaba for her unwavering support. “It has been an honour serving under your astute leadership and guidance. Your counsel made my role easier, and on behalf of Absa Bank, we wish you all the best in your future endeavours,” Kalifungwa said.

Prof. Barnabas Nawangwe was also recognised for his invaluable expertise and guidance during his tenure on the board. Opio highlighted Nawangwe’s role in talent management, advocating for diversity, and ensuring robust succession planning.

“We are grateful for his dedication and the positive impact he has had on Absa’s growth. He championed diversity through initiatives like Women in Leadership and played a crucial role in ensuring critical leadership positions were filled with the right talent,” Opio noted.

Nawangwe also spearheaded improvements in staff welfare, including enhanced remuneration, staff lunch benefits, and appreciation incentives.

In her farewell speech, Byarugaba commended the board and Absa’s executive team for their collective achievements. She credited the bank’s success to collaboration, customer trust, and an unwavering focus on innovation.

As the bank continues its growth trajectory, the leadership transition marks a new chapter for Absa Bank Uganda. The institution remains committed to delivering value to shareholders and enhancing customer experiences through digital advancements and innovative financial solutions.

Key Takeaways:

- Absa Bank Uganda recorded a 256% increase in profitability during Byarugaba’s tenure.

- Customer deposits reached Shs2.856 trillion, supported by digital innovations and customer engagement.

- Prof. Nawangwe advocated for diversity and improved staff welfare, leaving a lasting impact on Absa’s human capital strategy.

Absa Bank Uganda’s farewell to Byarugaba and Nawangwe underscores their invaluable contributions to the bank’s success and sets the stage for continued growth under new leadership.