Uganda Development Bank Ltd (UDB), the country’s national Development Finance Institution has announced its 2023 annual performance.

The annual performance report indicated that in 2023, the bank disbursed loans worth shs610 billion to grow its loan portfolio to shs1.47 trillion.

“UDB remains committed to fostering inclusive economic growth through strategic investments in sectors that drive sustainable development and job creation across Uganda. Our focus on key priority sectors underpins our mission to deliver high socio-economic value and support Uganda’s long-term development goals,” UDB Managing Director, Patricia Ojangole said.

She said the bank approved funding of shs692 billion in new loans to over 200 enterprises in 63 districts nationwide.

“These projects, upon full implementation, are expected to create 18,558 new jobs and generate an output value of shs11.4 trillion, from which shs616 billion will be generated as tax revenue to the Government, and shs3.34 trillion in foreign exchange earnings,” the bank’s annual report reads in part.

Through a multi-stakeholder partnership, the bank extended shs27 billion in funding to enhance water supply and improve water infrastructure, especially in scarcity-prone areas; under the program, up to 774 Kms in new water mains extension was realized, 27,307 new water connections realized, and 1,619 new public standpipes constructed to cater for 858 villages across the country.

Through a multi-stakeholder partnership, shs8.1 billion was deployed through the Hybrid Electricity Customer Connection Credit Framework, facilitating 38,833 new connections to the electricity grid nationwide.

The bank launched a shs150 billion funding allocation to support Ugandan contractors participating in infrastructure projects, a testament to our belief in the potential of local businesses.

Under its special programs proposition, UDB continued to focus on expanding its support to the youth, women, and SME segments – with an additional allocation (approval) of shs21.2 billion in 2023 and disbursement of an additional shs13 billion to support various enterprises across the country, demonstrating our commitment to inclusivity and equality.

Conversely, the earnings from locally produced destined products (exports) improved by 47% from shs649 billion to shs953 billion because of increased production, particularly in the manufacturing and agro-processing sectors.

Notably, up to 66% of all raw materials utilized in enterprises funded by the Bank were locally produced during the year.

“Prioritizing social inclusion in the Bank’s development agenda is fundamental in fostering a resilient, inclusive, and sustainable society where no one is left behind. To the Bank, social inclusion symbolizes diversity and social cohesion, unlocking the full potential of individuals and societal segments where everyone can fully participate, contribute, and thrive,” said Ms Ojangole.

In 2023, the Bank realized a post-tax (net) profit of shs49.8 billion, a 17% uplift from shs42.6 billion registered in 2022. This resulted from the sustained growth in the Bank’s balance sheet, matched by prudent investment in interest-earning assets while ensuring lean operations.

The bank continued to grow, with total assets closing at shs1.67 trillion in 2023, a 10% uplift from shs1.52 trillion the previous year.

Loans and advances (net) stood at shs1.47 trillion, growing 20% from shs1.22 trillion, underpinned by the shs610 billion new loan disbursements realized during the reporting period.

To fund the creation of these assets, the bank reinvested shs467 billion it collected as repayments from its borrowing customers and deployed shs97.3 billion received from government as additional capital contributions, complemented by an additional shs120.5 billion in drawdowns from various lines of credit held with its funding partners.

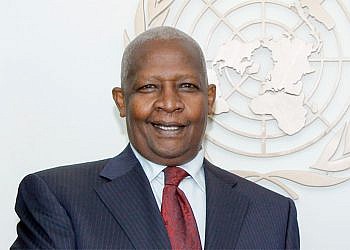

The Minister of Finance, Planning, and Economic Development, Matia Kasaija, lauded the bank for its exceptional contribution towards the realization of the country’s National Development Plan III and Vision 2024.

” Government has played a pivotal role in significantly contributing to the country’s socio-economic transformation. In 2024 and beyond, the focus will be on mobilizing adequate resources to enable UDB to continue to deliver its mandate. The Bank will also undertake the implementation aiming to accelerate productivity, import replacement, and export promotion. Additionally, the bank will advance its holistic sustainability agenda and deepen financial inclusion for SMEs, women, and youth,” he said.