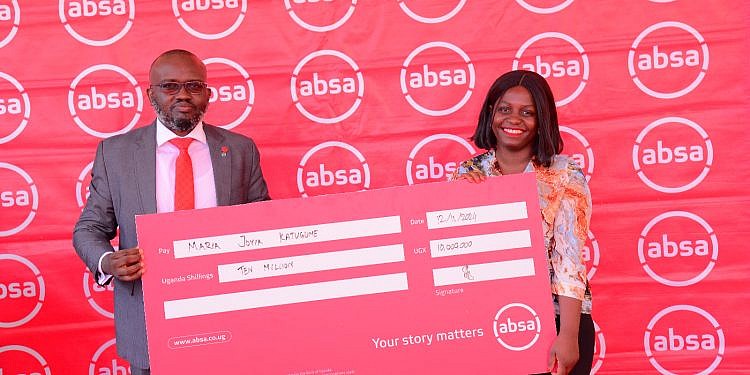

A total of 10 lucky customers were on Tuesday rewarded shs100 million in total for using Absa Bank Uganda’s debit and credit cards.

The winners used their Absa debit or credit cards at least five transactions in the period between September to October 2024.

This part of the “shs200 million can change your story” campaign that aims at demonstrating the bank’s strategic shift to being a more deliberately customer-centric business following the rollout of a refreshed brand promise of ‘Your Story Matters’.

“It is a pleasure to reward our customers for choosing convenience with our seamless banking solutions. With Absa debit or credit cards, customers can conveniently pay for goods, services, subscriptions, travel, and any other expenses both in-store and online. I encourage more customers to embrace the usage of the cards in their daily transactions,” said David Wandera, Executive Director and Head of Markets.

He said all Absa card holding customers are eligible to participate in the ongoing campaign and are required to simply continue to use their Absa debit or credit cards to pay for goods and services at least five times a month to stand a chance to win shs10 million.

As part of this promotion, a total of five customers will be rewarded monthly.

One of the winners Mr Allan Tusuubira applauded Absa for its commitment to rewarding customers

“I am excited to be among the winners in the Absa Bank card usage campaign. I have been using my debit card for most of my daily transactions and I am glad that my efforts have finally paid off. I would like to encourage fellow customers to continue using the cards, you may be the next lucky winner.”

Absa’s David Wandera said the promotion runs until December 31.

“There is still shs100 million up for grabs so I encourage our customers to continue using their Absa cards to pay for goods and services to stand a chance to win. In a bid to offer ultra convenience and seamless experiences to our customers, we have ensured Absa cards can be used to pay for goods and services offering convenient payment terminals spread out across various business locations,” Wandera added.